Understanding Temu and Its Growing Popularity in the U.S.

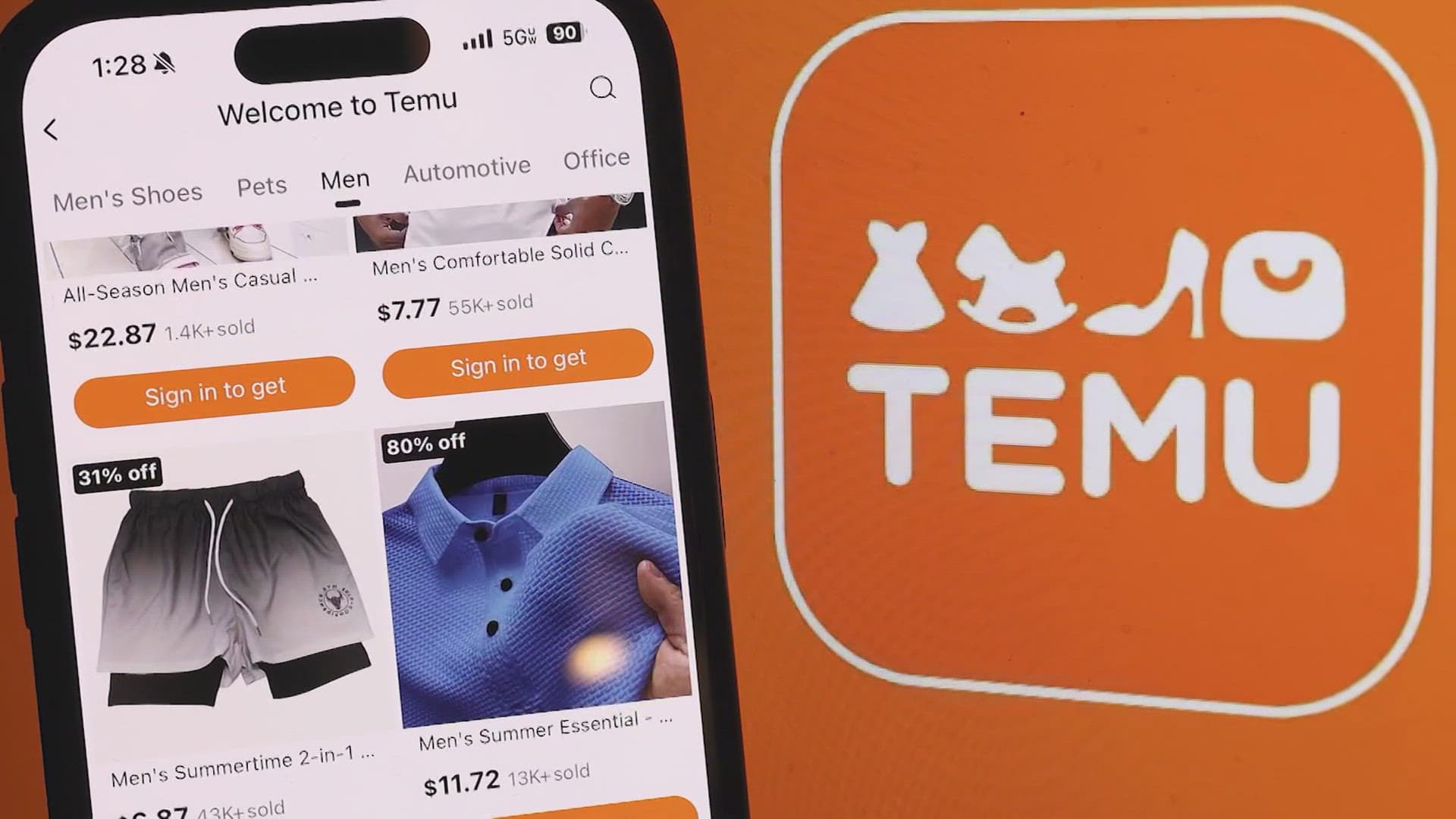

Temu has rapidly become one of the most talked-about e-commerce platforms in the United States. Known for its competitive pricing and wide product range, Temu gives consumers access to millions of affordable items — from fashion to electronics and home goods. With its increasing popularity, shoppers are curious about how to pay securely and efficiently on the app. That’s where understanding Temu payment methods becomes essential.

A convenient and secure payment process can make or break an online shopping experience. Temu recognizes this, which is why it supports a range of payment options designed to suit various consumer preferences across the U.S. Whether you’re using a credit card, PayPal, or digital wallet, Temu aims to make transactions fast, simple, and safe.

Understanding Temu and Its Growing Popularity in the U.S.

Why Temu Payment Methods Matter

For online shoppers, trust is crucial. Payment security and flexibility influence how often users shop and how much they spend. By offering multiple Temu payment methods, the platform ensures inclusivity and convenience for everyone — from casual buyers to frequent shoppers.

Moreover, the availability of secure and verified payment systems builds confidence among U.S. consumers who are still cautious about new online platforms. Temu’s focus on safe transactions, encryption, and data protection further enhances user trust.

Accepted Payment Methods on Temu

Temu provides a broad selection of payment options to meet diverse customer needs. Below are the most commonly used Temu payment methods in the United States.

Credit and Debit Cards

Temu accepts all major credit and debit cards, including Visa, MasterCard, American Express, and Discover. This is the most widely used method among American shoppers due to its convenience and speed. When you add a card to your Temu account, your details are encrypted to prevent unauthorized access.

Using a credit card on Temu also provides an additional layer of security through fraud protection and dispute resolution. If there’s ever an issue with a purchase, most card issuers allow users to file a claim and get a refund.

PayPal

PayPal remains one of the most popular Temu payment methods for customers who prefer an extra layer of protection. Linking your PayPal account allows you to shop without directly sharing your financial details with Temu. Transactions are processed through PayPal’s secure network, making it a reliable choice for privacy-conscious shoppers.

Moreover, PayPal often offers “Purchase Protection,” which can help buyers recover funds if their order never arrives or differs significantly from the description.

Apple Pay and Google Pay

Digital wallets have transformed online shopping, and Temu embraces this modern trend by accepting Apple Pay and Google Pay. These Temu payment methods are especially convenient for mobile users. Shoppers can complete a purchase in seconds using biometric verification, eliminating the need to type in card numbers.

Both Apple Pay and Google Pay use tokenization, which replaces your real card details with a unique encrypted code during transactions. This reduces the risk of online fraud and enhances the overall shopping experience.

Klarna and Afterpay (Buy Now, Pay Later)

Temu also supports Klarna and Afterpay — two popular “Buy Now, Pay Later” (BNPL) services in the United States. These Temu payment methods allow users to split their purchase into multiple installments, making it easier to budget larger orders.

This flexible option appeals to younger consumers and those who prefer spreading payments over time without paying interest, as long as they meet the payment schedule.

Temu Credits and Gift Cards

In addition to external payment systems, Temu offers its own in-app balance through Temu Credits and gift cards. Credits can be earned from promotional activities, refunds, or rewards. Using credits is simple: they automatically apply to your next purchase during checkout.

Gift cards, meanwhile, make excellent presents for friends and family who enjoy online shopping. These internal Temu payment methods encourage brand loyalty and convenience within the app ecosystem.

Accepted Payment Methods on Temu

How to Add or Manage Your Payment Methods on Temu

Managing your payment preferences on Temu is quick and user-friendly. You can access your wallet settings from your account dashboard in both the Temu app and website.

Here’s how the process works in general:

-

Navigate to “Your Account” and select “Payment Methods.”

-

Choose to add a new credit card, connect PayPal, or enable a digital wallet like Apple Pay.

-

Confirm your details and save the method as your default if you wish.

You can also remove or update outdated payment information anytime. This feature ensures flexibility and helps keep your transactions secure and accurate.

How to Add or Manage Your Payment Methods on Temu

Security Features Behind Temu Payment Methods

Temu prioritizes user protection by integrating advanced security systems. All Temu payment methods are supported by encryption technology and PCI-compliant payment gateways. This means that sensitive card data is never stored in plain text and is handled following international security standards.

Additionally, Temu uses anti-fraud systems that detect suspicious activity and prevent unauthorized purchases. The platform also encourages users to enable two-factor authentication for added account safety.

The combination of SSL encryption, secure gateways, and fraud monitoring ensures peace of mind for every transaction.

Common Issues and How to Solve Them

Although Temu strives for seamless payments, users occasionally face minor challenges such as declined transactions or processing delays. These issues can usually be resolved quickly.

If your payment fails, double-check that your card information is correct and that your account has sufficient funds. For digital wallets, ensure your device’s security settings are up to date. When using PayPal or Klarna, confirm that your linked account is active and verified.

Temu’s customer service is responsive and available to assist with any Temu payment method concerns, including refunds, chargebacks, or verification problems.

Tips for Safe and Smooth Payments on Temu

To make the most of your Temu shopping experience, follow a few best practices:

-

Always shop through the official Temu app or website.

-

Avoid sharing screenshots or payment confirmations publicly.

-

Use trusted payment options like PayPal or Apple Pay if you prefer extra protection.

-

Regularly update your app to access the latest security features.

-

Review your statements to detect any unauthorized charges early.

By following these simple steps, you can ensure every transaction remains secure and efficient.

Comparing Temu Payment Methods: Which One Should You Choose?

Each Temu payment method offers unique benefits. Credit cards are fast and come with strong buyer protection. PayPal appeals to those who prioritize privacy. Apple Pay and Google Pay are perfect for mobile convenience, while BNPL options like Klarna suit those who prefer financial flexibility.

For frequent shoppers, combining multiple payment options may provide the best balance between security and convenience. For example, you could use Apple Pay for quick purchases and PayPal for larger transactions requiring additional protection.

Temu continues to expand its footprint in the U.S. market by offering a variety of secure, modern, and flexible payment solutions. Whether you’re buying home décor, gadgets, or fashion accessories, the wide range of Temu payment methods ensures that every transaction is smooth and reliable. Understanding how these payment systems work not only improves your shopping experience but also helps you make smarter and safer financial decisions. As Temu grows, it will likely introduce even more payment options to meet the evolving needs of digital consumers.